One is a fifty-cent fee that Uber and Lyft riders in the city would pay for each trip. Transportation network companies (TNCs) would collect the fee through their apps and remit the money to the city.

Councilmember Rebecca Kaplan, the author of the tax measure, said at the council’s Finance and Management Committee meeting this morning that the new charge will impose “fairness” on large corporations like Uber and Lyft that currently use Oakland’s roads but don’t contribute anything toward their upkeep. She noted that taxis currently pay registration and taxes to the city, and this money helps pay to pave city streets, among other things.

“I’m sure this will Lyft up our city resources,” Councilmember Dan Kalb joked during the committee hearing today.

“Our city will become Uber strong,” Kaplan replied humorously.

The other proposed measure considered by the council committee earlier today would alter Oakland’s existing real estate transfer tax to create a progressively tiered rate schedule.

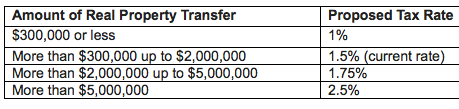

Properties, including homes and commercial buildings, that sell for more than $2 million would pay a higher rate than the current 1.5 percent the city imposes on all property, regardless of price.

Properties selling for between $300,000 and $2 million, which includes the vast majority of homes in Oakland, would continue paying the current rate, and any real estate that’s sold for under $300,000 would actually be taxed less.

Kalb’s office said the tax would primarily impact large commercial properties and a small number of very expensive homes.

Kalb’s chief of staff Oliver Luby told the committee that the tax is about fairly paying for public services in a society with “increasing wealth disparity.” Luby said the tax change would generate about $9 million in extra revenue each year.

Both tax proposals must still be approved by the city council’s Rules and Legislation Committee and then the full council in order to be placed on the November ballot. But if the proposals are approved, voters could enact the taxes by a simple majority. Revenue from both would be placed in the city’s general fund.

Councilmember Abel Guillen asked several critical questions about the transportation network company tax.

“I haven’t seen an analysis as to what this does to the everyday rider,” Guillen said. He noted that riders taking short trips and paying just a few dollars would be taxed just as much as riders taking long trips and paying more. He also wondered if the tax might reduce the use of TNCs, thereby increasing the number of private cars on the roads and undermining the city’s environmental goals of becoming more transit-oriented.

“This is a direct tax on consumers,” Guillen said.

Kaplan replied that the tax will drop from 50 to 25 cents per pickup for pool rides (when several people share the same Uber or Lyft) so as to incentivize more environmentally friendly practices by riders.

She also said that individual trips via TNCs don’t appear to reduce urban traffic congestion very much.

And she compared the TNC fee to the city’s existing hotel tax, which is paid by hotel customers. Two years ago, Oakland began collecting hotel taxes from Airbnb and other “home sharing” companies by requiring the companies to collect the 14 percent charge through the app and remit it to the city.

Councilmember Noel Gallo wondered whether Oakland can actually enforce the tax. “How do I make sure it gets collected,” he asked city staff.

Margaret O’Brien of Oakland’s revenue bureau said the city could pursue legal action against companies like Uber and Lyft if they refused to collect the tax. But she also noted that in the handful of cities that have imposed TNC taxes, companies appear to be complying.

Both the TNC tax and progressive RETT tax will likely face opposition from tech companies and the real estate industry if they’re placed on the ballot.

Gallo said at today’s committee hearing that representatives of Uber already met with him and lobbied against the TNC tax.