Cheri King’s house on 64th Avenue in East Oakland’s Havenscourt neighborhood has pale blue trim, a brick chimney, and a shady front porch sheltered by a gently sloping gable. Dozens of other bungalow-style homes line the surrounding streets. Each is slightly different from the next, modified over the years by their owners.

King, a tennis teacher who runs a youth sports program for the City of Berkeley, bought her house fourteen years ago for $140,000. She originally planned to rent it out, but then decided to move in herself. When I visited King several weeks ago, her living room was crowded with moving boxes piled so high they obstructed the light coming in through the windows. A bin filled with hundreds of tennis balls and dozens of racquets lay near the front door.

Cheri King managed to remain in her foreclosed home in East Oakland for a year. Credits: Darwin BondGraham

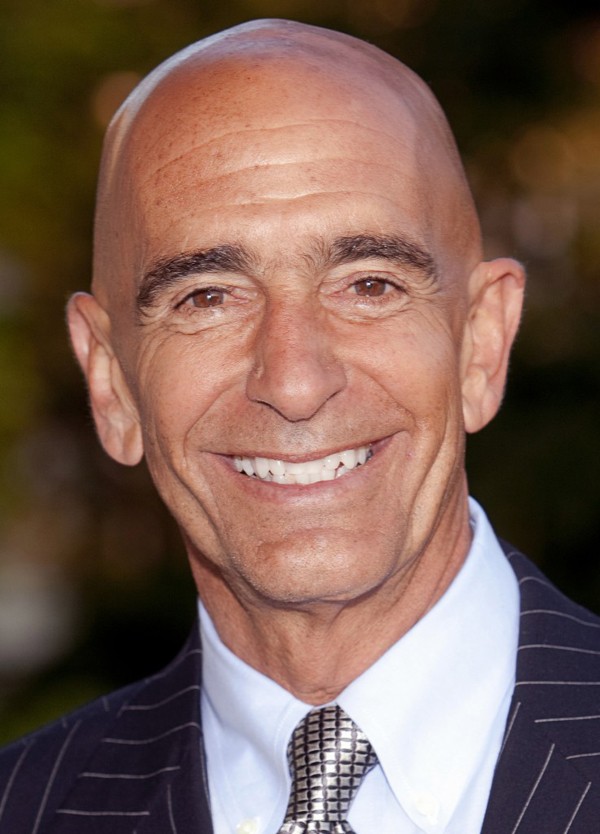

Thomas Barrack Jr.

Barrack’s Colony Capital is one of the deep-pocketed investors behind Coliseum City.

Colony Capital is also a major investor in the Fairmont Hotels chain, which is buying the Claremont Hotel.

Gary Beasley (center) and Doug Brien (right) celebrate the formation of Starwood-Waypoint Residential Trust. Credits: Darwin BondGraham

A Waypoint rental in East Oakland. Credits: Darwin BondGraham

A Colony foreclosure-turned-rental in East Oakland. Credits: Darwin BondGraham

“I had a baby grand piano in here, but I had to get rid of it,” said King in the dark living room. “I’m collateral damage in this war between the haves and the have-nots. I’m collateral damage of the banks.”

One year ago, Wells Fargo Bank foreclosed on King’s house after she struggled to catch up on mortgage payments she had missed during the Great Recession. “Suddenly, people in Berkeley weren’t taking tennis lessons,” she explained. King scrambled to make a deal with the bank to stay in her house. She applied for California’s Mortgage Reinstatement Assistance Program, a state-run, federally funded form of temporary financial assistance. She was denied, but then applied for the similar state-sponsored Principle Reduction Program to lower her monthly mortgage to a price she could afford.

“They told me I was approved. Then they told me not to worry, the paperwork was being processed,” she recalled. King knew something was wrong, however, when she asked Wells Fargo representatives if they had received the necessary paperwork from the Keep Your Home California program that would halt the foreclosure. Wells Fargo officials said they had received the paperwork, but said that King had missed the deadline to stop the sale of her home by just two days.

“I received a three-day notice to quit,” King wrote bitterly to a housing assistance program worker, referring to an eviction notice that had been stuck to her front door. “You said everything was ok and I should not worry.”

“I’m so very sorry for this happening to you,” the assistance worker responded in an email. “As I said before you might want to seek [legal counsel].”

Then King’s situation took an unexpected turn. Although she was still living in her home, Wells Fargo sold it to a company with an obscure name — Colfin AI CA 5 LLC. The new owner hired Strategic Property Management, an Agoura Hills, California real estate firm, to rent out the house for $1,650 a month to a new tenant.

“I have no idea who this company is,” King told me. “But they moved to evict me.”

She fought through the courts, and, through sheer will, managed to stay in her house throughout 2013. At one point, representatives for Colfin AI CA 5 LLC told her they would rescind the sale of her home if Wells Fargo would agree to do so, but that promise went nowhere, she said. King said she’s spent countless hours looking for somewhere to live, but that the rental market is unusually expensive right now. According to Oakland’s Department of Housing and Community Development, apartment rents in Oakland increased 12 percent in 2012, and then shot up 15 percent last year.

Last month, a lawyer representing Colfin AI CA 5 LLC managed to convince an Alameda County Superior Court judge to force King out of her home by February 15. When speaking about the experience, King sounded equally sad and angry.

“Keep Your Home California didn’t work,” she said about the government program intended to help homeowners like her. “Get what you can, hurt people along the way. That’s how the economy works now.”

There are landlords, and then there are land lords. The obscure company that bought Cheri King’s house and evicted her, Colfin AI CA 5 LLC, is a tiny part of a global real estate empire called Colony Capital. Colony is headquartered in Santa Monica, but has offices in China, France, Italy, Lebanon, South Korea, Spain, and elsewhere. Colony Capital’s holdings include $50 billion in property scattered around the world.

The company’s newest colony is Oakland, where, through several shadowy limited liability companies, it has bought up at least 26 single-family homes, mostly in 2012 and 2013, including Cheri King’s, according to records in the Alameda County Assessor’s Office. In addition to investing in foreclosed homes, Colony Capital is one of the primary investors behind Coliseum City, the giant 800-acre waterfront redevelopment project proposed for the Oakland-Alameda County Coliseum property and the area immediately surrounding it. Mayor Jean Quan has described Colony Capital as having “very deep pockets.” The company is also one of the major investors in FRHI Hotels & Resorts, which owns the Fairmont hotels chain and is in the process of buying one of Oakland’s most iconic landmarks, the Claremont Hotel.

The deep pockets behind Colony Capital belong to Thomas J. Barrack, Jr., whose personal net worth is estimated by Forbes to be $1 billion. Barrack owns a 1,200-acre mountain ranch in the hills above Santa Barbara and circles the planet in his private jet to seal real estate deals with Saudi princes and Japanese tycoons. He owns casinos in Las Vegas, Switzerland, and Egypt, and hotels in the French Alps and Dubai. Now, he and his business partners own Cheri King’s house, and they plan to squeeze profit from it.

Back in 2005, when Oakland residents were signing half-million-dollar-mortgage agreements to buy homes that were valued at a fifth of that price five years before, Barrack told Fortune magazine that he was getting out of the real estate game. “There’s too much money chasing too few good deals, with too much debt and too few brains,” said Barrack. “The amateurs are going to get trampled.”

The stampede began in 2008, and Oakland was trampled badly. However, according to academic researchers who have studied the financial crisis, it wasn’t because local “amateurs” were chasing deals with hot money, or, as conservative pundits have claimed, because low-income buyers were irresponsible and bought homes they couldn’t afford. The financial crisis was a macroeconomic problem, fueled by central bank policies, banking industry deregulation, and the avaricious decisions of the financial sector’s highly paid CEOs, especially those leading the mortgage lending industry.

Deregulation of the mortgage industry allowed banks to sign borrowers up for explosive loans with usurious rates and to bury homeowners in debt. The banks often used misleading advertising to lure borrowers in. For example, Cheri King’s original mortgage loan included an “adjustable rate rider” that allowed the bank to set her initial interest rate at 9.99 percent, according to the Deed of Trust on file with the Alameda County Recorder’s Office. Her interest rate thereafter was reset every six months, but according to the deed, it could never fall below 9.99 percent, and could rise as high as 15.99 percent.

Alex Schafran, a lecturer in urban geography at the University of Leeds in the United Kingdom who has studied the foreclosure crisis in the Bay Area, said the impact of home losses and investor buying has been hardest on African-American and Latino households. “The crisis, people losing their homes during the crash, was racialized based on who got subprime loans, and who bought these houses in markets where prices were inflating fast,” explained Schafran.

All of the banks that owned Cheri King’s home loans over the years, including Long Beach Mortgage Company (a subsidiary of Washington Mutual), World Savings Bank, Wachovia, and the eventual owner of the mortgage, Wells Fargo, have settled multiple cases with the US Department of Justice (DOJ) and states’ attorneys general for conducting predatory and discriminatory business practices that led to millions of foreclosures nationwide.

The loan King used to buy her house came from Long Beach Mortgage Company. Long Beach Mortgage was investigated by the DOJ in the mid-1990s because, according to a government lawsuit, “the [b]ank engaged in lending practices that constituted unlawful discrimination on the basis of race, national origin, gender and age,” and “treated African American, Hispanic, female or older borrowers differently from younger, white male borrowers by charging them higher prices for mortgage loans.” (King is African American.) Long Beach Mortgage Company employees were paid commissions based on the number of loans they executed, creating a perverse incentive to push low-income borrowers into subprime mortgages whether or not they could afford them.

In 2004 and 2005, Oakland-based World Savings Bank loaned King money against her home. World Savings Bank was one of the most prolific and controversial lenders during the real estate boom of the last decade. Paul Bishop, an employee of the bank, called the company an “Enron,” because World Savings was purposefully extending subprime and adjustable rate loans that trapped borrowers in interest-only payments that actually grew the debt they owed. Wachovia Bank ended up buying World Savings in 2006 just before the crash, obtaining King’s mortgage in the process, and when the crash came, it was World Savings’ multibillion-dollar portfolio of toxic loans that destroyed Wachovia. Wachovia was subsequently sold to Wells Fargo, once again along with King’s home loan.

In 2010, then-California Attorney General Jerry Brown reached an agreement with Wells Fargo pertaining to the World Savings Banks’ destructive lending practices. Wells Fargo promised to provide loan modifications for $2 billion in World Savings Bank loans made during the 2000s, but it’s not clear how many people’s homes were saved.

Wells Fargo, Wachovia, and Washington Mutual also were at the center of the $25 billion national mortgage settlement stemming from the same abusive practices that King says Wells Fargo used to take her home away — obstructing loan modification, lying about paperwork and deadlines, and pursuing other bad-faith strategies in order to rapidly foreclose on struggling homeowners. The national mortgage settlement was supposed to stem the foreclosures and save people’s homes through loan modifications like the one King was seeking. Instead, the settlement has come up short, and few homeowners have received meaningful assistance.

Meanwhile, opportunistic corporations and investors have stepped forward to profit from the fallout.

The mission of Thomas Barrack’s company, Colony American Homes, is to buy up as many single-family homes as possible while the prices are still low, and to convert them into rental units in order to harvest income for wealthy investors.

“The price is right,” said Sarah Edelman, a policy analyst at the Center for American Progress who has closely tracked the rise of institutional investors in the residential housing market. “These companies are able to buy homes at serious discounts right now. It’s a business opportunity that hasn’t presented itself ever before because there’s so many cheap homes, but there’s tight credit for individual homebuyers, and more renters after the foreclosure crisis.”

Schafran explained further: “Whereas the real estate bubble of the 2000s created artificial values in land and housing, the crash created the opposite, homes that are worth more than their price. … What we’re seeing right now is big chunks of capital, some of them having emerged largely unscathed from the financial crisis, all of a sudden they’re sitting on big pools of money and they have to reinvest it.”

According to Edelman and Schafran, major investors like Colony have been buying up homes for several years now in cities that were severely impacted by the foreclosure crisis, including Atlanta, Phoenix, Miami, and Las Vegas. In some markets, Edelman said, they have actually pushed up the prices of houses and squeezed out mom-and-pop investors and owner-occupiers. The rise of these new corporate housing investors, focused on a market of single-family home rentals, has been so sudden and unprecedented that the national business press has dedicated significant resources to cover this trend. Reporters from the Wall Street Journal, Forbes, Bloomberg, and others have written extensively about the growth of this now multibillion-dollar industry, which feeds off the pipeline of foreclosures and the growing ranks of people who can’t afford to buy a home anymore.

Colony American Homes is one of the biggest players. In its most recent regulatory filings with the US Securities and Exchange Commission, Colony claims to have spent more than $1.8 billion to obtain 12,247 homes in nine states. All of these houses were “distressed” sales, meaning foreclosures or short sales, sometimes made in bulk by bank owners, but often also bought at auctions held on county courthouse steps where speculators and flippers have fought over the spoils of the recession.

Most of the money behind Colony American Homes has been contributed by a network of limited liability companies controlled by Barrack and a few of his business partners, some of which are incorporated in offshore tax havens in the Cayman Islands. One of the single biggest funders of Colony’s single-family-home buying spree has been the University of California. According to securities filings, UC owns a 6 percent stake in the company.

Representatives from Colony Capital and Colony American Homes did not respond to emails and phone calls requesting comment for this report.

The company’s website lists many houses for rent in Richmond, Antioch, Pittsburg, and Bay Point. An SEC filing from 2013 showed that Colony owned at least 142 homes in the Oakland-Fremont metropolitan area. An examination of records in the Alameda County Recorders Office shows that Colony has been buying up foreclosed houses in Hayward, San Leandro, and Berkeley, in addition to Oakland. Colony has acquired another 90 homes in Vallejo and Fairfield, and 114 homes in Sacramento.

Edelman sees numerous problems in the rise of this new foreclosure-to-rental industry. Perhaps the biggest is the fact that millions of families have seen their savings evaporate, and, just as home prices have begun rising again, many families are finding themselves unable to purchase houses and regain equity. Instead, large, cash-flush investors are monopolizing the wealth recovery.

“I think that as this industry grows we could see another massive income transfer,” said Edelman. “Corporations can access credit more easily, therefore they have a disturbing advantage over a family in buying a home. There are a lot of qualified borrowers right now that can’t get mortgages,” borrowers who will therefore miss out on home price recoveries.

Edelman is skeptical that these investors will benefit the communities in which they have established “home rental platforms,” as they call their concentrated property holdings. “With investors, we don’t know when they’re gonna leave a community,” said Edelman. “And when they do leave they’re likely to take price gains with them. This creates a more volatile market.”

Colony Capital is only one of many private equity-backed companies to take advantage of the foreclosure crisis by transforming single-family homes into profit generators for wealthy investors. In fact, the industry was arguably created by a pair of investors right here in Oakland.

In June of 2009, when banks were still failing and homeowners were defaulting on mortgage payments in record numbers, Doug Brien and Colin Wiel were pooling their personal savings with a few friends and buying foreclosures in the suburban sprawl of east Contra Costa County.

Brien, a former NFL placekicker, including for the 1994 Super Bowl champion San Francisco 49ers, grew up in Concord. His business partner, Wiel, is a UC Berkeley-trained engineer who got rich selling an e-commerce startup to eBay. The pair’s first fund to acquire foreclosures and turn them into rentals was incorporated under the name Wiel Brien LLC. Their small office was in the Piedmont Executive Center building on Grand Avenue. Their strategy promised to be so lucrative that they quickly incorporated several more funds with generic names like BCG-Wiel Brien Fund 3, LLC. As the money poured in from investors to acquire even more foreclosed houses, they traded up their corporate real estate, moving their offices to the 1999 Harrison tower overlooking Lake Merritt, and they incorporated Waypoint Homes.

Twenty-two floors up, Waypoint’s national headquarters has sweeping views of the Oakland hills and the flatlands toward San Leandro. Using binoculars, the company’s employees could see perhaps seventy of their investment homes sprinkled around the San Antonio and Fruitvale neighborhoods, and especially concentrated between Seminary Avenue and 104th Avenue below the I-580 freeway. The walls of Waypoint’s headquarters are decorated with framed photos of the company’s early home purchases, and even portraits of families who rent company properties. Etched in a glass wall facing the lobby is the motto: “reinventing renting.”

Waypoint’s leaders say their business strategy is underwritten by socially conscious goals. “We want people to have a different experience with us,” Waypoint’s CEO Gary Beasely told me. “Our relationship is about respect because a lot of our tenants have been through the ringer.”

Beasley said Waypoint’s home buying has helped stabilize neighborhoods, and that his company is out to prove that it will be the best landlord possible. “I would argue that institutional landlords will be more responsive than the mom-and-pop landlords,” he said. “A lot of smaller landlords are actually absentee, they don’t use a good management company, and it’s hard for tenants to get work done. We, on the other hand, have a brand that we’re trying to grow.”

Beasley also points to the capital that big investors like Waypoint have injected into housing stock as a positive contribution his company has made to hard-hit communities like Oakland. Waypoint, which has been financially backed by Columbia University’s endowment and a Menlo Park private equity firm called GI Partners, has spent about $800 million acquiring homes in California, Arizona, Georgia, Illinois, Florida, and Nevada. Of this total, Beasley estimates that about $150 million has gone toward repairing and renovating the homes — capital invested straight into local communities hard hit by the foreclosure crisis. In Oakland, Waypoint has spent about $20 million buying up distressed homes, and about $3 million of this went toward renovations. In Contra Costa County, Waypoint is a dominant player in the market for single-family homes, having bought up seven hundred houses since 2009, investing yet more money in the local economy.

“We needed the capital to flow in from somewhere, whether from private capital or the state,” said Schafran about hard-hit communities like Antioch and East Oakland, where neighborhoods and real estate prices were threatened by rows of empty houses. “Capital came in. Waypoint is providing a product that’s useful in the market,” he continued. “They’re pulling a big chunk of housing out of disrepair and making it available in in-between ways.”

Oakland’s Waypoint just completed a merger with a spinoff of a larger real estate corporation called the Starwood Property Trust. Beasley said the deal, which allows the newly named Starwood-Waypoint Residential Trust to tap investor capital through the New York Stock Exchange, will allow Waypoint to expand with even more home purchases in Florida, Texas, Atlanta, and Chicago. The merger essentially creates a Wall Street-backed company with virtually unlimited capital.

“There’s still opportunity to deploy capital in those places,” Beasley said about markets in Arizona, Georgia, Florida, and other states. “The market has slowed down in California though, with homes that sold for $150,000 now selling in the $200,000 to $250,000 range.”

“Yields are considerably lower,” Beasley said about the opportunity for more home-buying in the East Bay, especially in Oakland.

Yield, in business-speak, refers to the income that an investment generates for its owner. In real estate, this is usually the rental income a landlord receives from a tenant, expressed as a percentage of the property’s original purchase price. In the world of multi-hundred-million-dollar real estate acquisitions, calculating yields on rental properties can be complicated. But for companies like Waypoint and Colony Capital, the yield on their investments in single-family homes will basically be determined by how much they can charge their tenants in rent minus the average cost of acquiring and fixing up the homes, and managing them as rental properties.

When you do the math, the profit looks substantial. For example, take 4711 Fairfax Avenue in Oakland, a single-story home with a detached garage two blocks off High Street. A family bought the house for $400,000 in 2004. They lost the home to JP Morgan Chase, the nation’s largest bank, in 2011. Waypoint acquired the house in July 2012 through its Dallin, LLC subsidiary at an incredible discount of $170,000, according to assessor’s records. The home was briefly listed on Waypoint’s website renting for $2,249 a month. Before deducting expenses related to the purchase, renovation, and management of the house, Waypoint’s yield on the investment is about 16 percent a year. Waypoint representatives say the company has developed several proprietary algorithms that crunch data, including a home’s purchase price, expected renovation costs, and neighborhood attributes, to instantly determine the maximum bid they’re willing to make in auctions for foreclosed housing. The company also has a secret “screening algorithm” to select its tenants.

But yield isn’t the only profit sought by major housing investors like Colony and Waypoint. The houses they’ve been buying have rapidly appreciated in price over the last two years, especially in the East Bay. For example, the average home price in Antioch peaked in 2006 at just over half a million, but then in 2009 collapsed to around $180,000 where it lingered until about May 2012. Since then, Antioch’s average home price has climbed back up to about $260,000. Buy low, sell high, and harvest the difference as a capital gain — that’s what big investors are also counting on doing when they purchase distressed single-family homes.

In a recent presentation to investors, Starwood-Waypoint representatives said they expect home prices to rise by 33 percent in Oakland between now and 2017, and that in Vallejo and Fairfield home prices might rise as much as 82 percent.

The ownership histories of thousands of Oakland homes tell the story of how big investors are chasing high yields and capital gains by turning East Bay foreclosures into rentals. The house at 1750 104th Avenue in deep East Oakland, a modest single-story cottage built around the middle of the last century, was priced below $100,000 for decades. Then the roaring 2000s hit and its price shot up to $300,000, then $400,000. When Jose and Maria Juaregui purchased the home in 2004, the couple bought it for $410,000, according to assessor’s records.

When the economy crashed in 2008, the price of the house sank with it. Underwater, the Juareguis lost their house to Bel Marin Keys, LLC, one of the hundreds of limited liability companies set up by speculators to play Oakland’s volatile housing market. Bel Marin Keys paid $115,000 for the Juareguis’ home, a discount of 70 percent. Then Bel Marin Keys flipped the house, selling it to Craige, LLC for $225,000. Craige, LLC is a subsidiary that Waypoint has used to buy homes in Alameda and Contra Costa counties.

There are thousands of houses in Oakland that have this same basic history. There’s the small cream-colored bungalow at 6428 Foothill Boulevard, bought for $465,000 in 2006, and foreclosed on in late 2007. This home was eventually purchased by a San Mateo company called Oak Hill Investors, LLC for a stunningly low $60,000 in May of 2009. Oak Hill then sold the house to Waypoint for $190,000, according to county records.

Or take 1229 82nd Avenue, bought by Guillermina Hernandez in 2005 for $370,000. The British mega-bank Barclays foreclosed on the loan in February of 2009 and a flipper from Fremont bought the property for a mere $55,000 six months later. Waypoint acquired this home last year for $115,000.

If one reads the deeds of Oakland’s real estate transactions over the past few years, another pattern emerges in the foreclosure-to-rental pipeline. Many of the buyers at the height of the real estate bubble had Latino and Asian surnames. Many were African Americans. They sank their life’s savings into down payments, and their mortgages were often of the subprime variety with variable interest rates and other gimmicks. When the bottom fell out of the market, their savings vanished, and their communities, neighborhoods like Allendale and Maxwell Park, got hammered.

“Maxwell Park was historically a bastion of African-American homeownership,” Margaretta Lin told me in her office recently. Lin is the director of strategic initiatives for Oakland’s Department of Housing and Community Development, a role that requires her to think big about how to prevent displacement and create an affordable, housing-secure city. Although Lin has focused much of her attention on how to slow and reverse the tide of foreclosures in Oakland, she has also initiated programs to ensure banks and investors do not harm the city’s fragile neighborhoods. For example, Oakland now requires housing investors to register with the city so that their activities are better monitored by community groups and government, and the city is proactively fining banks that allow foreclosed properties to become blighted. The city has inspected 234 properties and collected $765,000 in fees and penalties from banks over the past year.

Lin’s biggest challenge during the past several years has been to find ways to prevent banks from foreclosing on and evicting community members. “When the economic crisis escalated, our ability to address problems dramatically decreased,” said Lin. “The city had no bandwidth at the time because we were struggling financially ourselves.”

According to Lin, many Oakland residents were hit hard by the economic crisis and the foreclosure wave initiated by the banks, in part because there was no government or nonprofit infrastructure for homeowners to turn to for help. “There were no nonprofits in Oakland that had a program to do single-family,” either through assisting homeowners to keep their house, or by taking over foreclosed properties and rehabilitating them. “So we ended up being a city that had housing stock available, and investors buying it.”

“My job right now: I see it as building infrastructure for the long haul to provide alternative ways to stabilize neighborhoods and keep people in their homes, alternatives to purchases by investors.” The goal is to create options for a more equitable housing in the city, she explained.

This infrastructure includes outreach programs, counseling for homeowners experiencing financial hardship and bank obfuscation, and even a financial assistance programs to prevent foreclosure through the Restoring Ownership Opportunities Together program (ROOT). The city council approved funding for these programs in October 2012.

But to date, staff reports show that only one Oakland household was able to avoid foreclosure with help of the city’s ROOT program. Negotiations to prevent two other foreclosures by Wells Fargo and one by Bank of America are underway.

A representative for Wells Fargo said the bank has extensive outreach programs to help its borrowers avoid foreclosure. “March of this year will be the third time that Wells Fargo has hosted a Home Preservation Workshops in Oakland and the fifth such workshop in the East Bay where more than 2,700 homeowners have attended,” bank spokesperson Mariana Phipps wrote in an email. According to Phipps, “for every Wells Fargo customer that has gone into foreclosure in the Oakland metropolitan statistical area, the bank has helped or is helping three more with alternative options.”

Steve King, coordinator of housing and economic development at the Oakland-based Urban Strategies Council (and no relation to Cheri King), said that while the city and groups like his have helped struggling homeowners and neighborhoods, these efforts fall far short of what’s needed. “The resources made available by the federal government to cities like Oakland, they just didn’t match the scale of the problem,” said King.

Urban Strategies Council and residents affiliated with the local chapter of ACORN set up the Oakland Community Land Trust (OakCLT) during the height of the housing crisis in 2009 in an effort to purchase foreclosed homes and get them back into the hands of low-income Oaklanders. Initially, they envisioned a program to buy hundreds of homes, renovate them, and move in hundreds of low-income Oakland residents. “There were over 13,000 foreclosures in Oakland,” said King. “We’ve acquired seventeen houses and have all but two in contract with homebuyers who fall within 50 to 80 percent of the area median income — $46,000 to $67,000 a year for a family of four,” said King.

The Oakland Community Land Trust is a long-term solution. It didn’t have much impact on the foreclosure crisis in Oakland.

“We looked at over four hundred properties just to acquire the seventeen we now have, and we had to compete with investors,” explained King. Many times they were priced out of an otherwise good deal; investors like Colony, Waypoint, and others have deep pockets, billions in private equity and university endowment cash, and now access to Wall Street’s equities market. The Community Land Trust depends on federal loans and operates on a small budget. Even so, King believes the model his group has established is superior to the status quo of allowing large investors to buy up all of the East Bay’s foreclosures.

“When you talk about the rents these investors are charging, they are unreasonable for many longtime Oakland residents,” King said. “Monthly mortgage payments, including taxes and insurance, for a typical OakCLT homebuyer average around $1,000 per month. These are affordable and sustainable asset building opportunities for families of modest means — assets that stay in the community.” According to King, a typical house acquired by the OakCLT cost $76,000, and his group has poured twice this amount — about $155,000 — into rehabbing each property, proportionally much more than the corporate landlords. With a sales price averaging $132,000, the mortgage payments on an OakCLT home are about $850 a month.

Rents charged by the new corporate landlords vary. Waypoint’s website has listed multiple houses in Oakland over the past several months, with rents ranging from $1,499 to $2,249. Colony American Homes has listed three Oakland houses for rent priced between $1,575 and $1,650.

Giant for-profit corporate investors are also looking toward the future, socking away housing in single-family home rental platforms, and seeking billions more in cash to grow their real estate holdings. Besides Colony and Waypoint, there are several more corporate investors active in the East Bay housing market.

The Blackstone Group, a New York private equity giant that describes itself as an “alternative asset manager,” incorporated Invitation Homes in 2012. Since then, the company has scooped up more than 30,000 foreclosed houses across the country valued in excess of $7.5 billion. Blackstone recently sold a portion of Invitation Homes’ property holdings to investors as a part of a securitized bond, which is similar to the mortgage-backed securities sold by banks in the 2000s, which bundled home loans of thousands of borrowers around the country into one trade-able security. The bond included 239 houses valued at a quarter-billion dollars in Phoenix. The bond’s income stream also derives from 239 homes worth a total of $50 million in Sacramento, 43 homes in Vallejo and Fairfield worth $11 million, and 10 houses in Oakland worth $2.6 million.

“Through Invitation Homes, we are providing a much-needed service for communities across the nation,” wrote Blackstone’s executives in their most recent annual report to shareholders. “We are removing from the market distressed inventory, which has been suppressing national home prices, creating jobs and providing high quality, affordable housing for families.”

Whether or not they are “positively impacting communities,” as Blackstone claims in their company reports, large investors are poised to take over more of the national market for single-family homes. A 2011 report by the investment bank Morgan Stanley reported that homeownership rates have been falling dramatically and are likely now below 60 percent, creating what the authors call a “rentership society.” The report concluded that “[e]ach distressed single-family liquidation creates a potential renter household, as well as a potential single-family rental unit.”

Starwood-Waypoint commissioned a study by the John Burns Real Estate Agency, a respected consultant, to estimate the fortunes of the single-family-home-rental industry. According to the report, published in January in a company securities filing, “for every 1% decline in the homeownership rate, the occupants of approximately 1.1 million homes become prospective tenants,” and therefore potential customers. Figures published by the US Census Bureau last month show that the nation’s homeownership rate has dropped by 4 percent since 2006.

“We also believe that there continues to be a large amount of potential supply that we can purchase at potentially attractive pricing,” wrote Starwood Waypoint’s executives. “At the current rate of delinquency and non-performance, it appears that over 4.0 million homeowners in the United States will be affected.” This in turn is creating a $400 billion opportunity for America’s new corporate land lords.

As for Cheri King’s future, in the near term she will become part of the rentership society, a tenant forced to seek shelter from a housing market increasingly controlled by fewer and larger investors. Her time is up this month and she has agreed to move out of her home of fourteen years, and into an apartment. “I’m gonna get my house back one day, though,” she vowed.

Correction: The original version of this story misstated Alex Schafran’s job title. He is a lecturer in urban geography at the University of Leeds in the United Kingdom who has studied the foreclosure crisis in the Bay Area.